Stock markets are represented by various participants, who differ in the functions they perform

and the size of their

capital. The biggest players in the stock market are institutional investors. So who are

institutional investors?

Institutional investors are large credit and financial companies that serve as intermediaries

between investors and

investment objects. Through the accumulation of investor money, institutional investors earn a

certain margin for

intermediation and act as brokers, managers, auditors, financial advisors, etc. They participate

directly in securities

trading and may be represented by banking and brokerage alliances, investment companies.

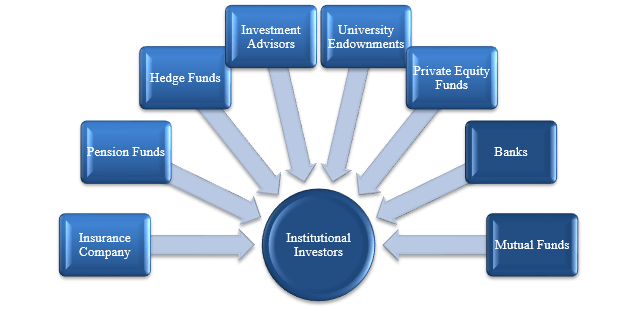

For a better understanding, Figure 1 shows the types of institutional investors.

Figure 1 – Institutional Investors

Let's take a look at each type of institutional investor.

The biggest players among institutional investors are investment companies. A prime example is the

Big Three - Vanguard

Group, BlackRock and StateStreet. These companies offer units of their investment funds (mutual

funds, ETFs, etc. -

diversified portfolios) and other financial services and financial instruments. Such companies have

the ability to have

a significant impact on the stock market because of the large trading volumes and the huge capital

under management.

Insurance companies are characterized by the fact that by accepting insurance premiums from

customers, they form

insurance funds, at the expense of which they compensate the financial losses of customers.

The next type is pension funds. Pension funds also play an important role in the financial market.

There are two options

of pension security. The first option is a "defined benefit pension fund" - when a person retires,

they receive a

predetermined and guaranteed amount. The second option is a "defined contribution plan", the person

receives a certain

amount based on the performance of the fund.

Endowment funds are investment funds that are designed for a specific purpose and need. Such funds

are usually used by

universities, hospitals, and other nonprofit organizations. The invested capital is used for

specific purposes, and the

donors of such funds can establish how the funds are used.

Banks are financial structures that carry out various operations. They attract capital from

individuals, companies by

offering a certain interest on a deposit, and banks can also issue their own securities (shares,

bonds). In addition,

banks can act as brokers in stock trading, accompany transactions and create depositories for

storing securities.

Hedge funds invest mostly in liquid assets. Hedge funds are unique in that they apply a more

aggressive investment

policy and are riskier, but the returns are also higher.

Institutional investors play a key role in the economy as a whole by redistributing financial

resources from one

industry to another. They manage very large assets and capital of various contributors, which allows

assets to be

redistributed to certain market segments, and large capital to be used for strategically important

tasks. In addition,

institutional investors also bring benefits to both companies and private investors. For companies,

institutional

investors are an important source of capital. As for the advantages for private investors, the

following can be said

here. Not all private investors have expert knowledge of how the stock market works, how to invest

effectively, how to

trade securities and manage risks, while institutional investors have this expertise, so for private

investors, trust

management is sometimes the best solution. Also, institutional investors do larger trading volumes,

which allows them to

have lower transaction costs and offer financial services to private investors at lower prices, so

private investors

ultimately benefit from this.