Exchange-traded funds have recently become an increasingly popular financial instrument used by both

private investors

and institutional investors. Let's understand what exchange-traded funds are and how they

work.

ETFs are a type of investment fund that tracks the performance of a stock market index, industry

sector or asset, giving

investors access to securities, equity, other assets, commodities, etc. ETFs are bought and sold

like stocks, but at the

same time, ETFs do not sell stocks directly because they actually buy stocks in a portfolio, i.e.,

they sell a portion

of an investment portfolio consisting of various financial instruments and assets. ETF stocks are

called creation units,

such stocks are issued in large blocks. There are different types of ETFs, such as:

- Index ETFs - these exchange-traded funds attempt to follow an underlying index, they are an

inexpensive and efficient

way to invest in various portfolios

- Actively managed ETFs - these exchange-traded funds are managed by a portfolio manager or team,

adapting the fund to

market changes and being responsible for portfolio allocation

- Targeted risk exchange-traded funds - these funds are also a diversified portfolio, the feature

being that the fund's

management team or manager gradually reallocates the fund to make the portfolio less risky

- Bond ETFs - such funds invest in bonds, depending on the type of bonds these funds are classified

as medium-term bond

ETFs, corporate bond ETFs, long-term bond ETFs, high-yield bond ETFs, etc.

- Commodity ETFs - such funds track the prices of commodities such as gold, oil, etc.

In addition, depending on the structure of the fund's portfolio, there are stock funds such as real

estate ETFs, global

stock ETFs, diversified emerging markets ETFs, mid-cap ETFs and many others.

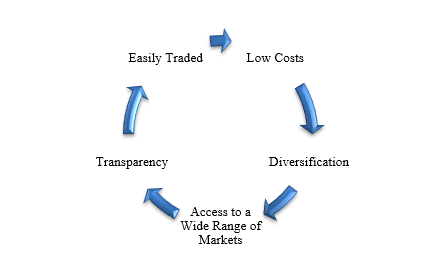

The main advantages of ETFs are shown in Figure 1.

Thus, exchange-traded funds provide investors with the broadest investment opportunities, that is why they have become so popular. In 2020, the value of global assets managed by exchange-traded funds was $7.74 trillion, and the number of exchange-traded funds worldwide was 7,602, an increase of 2,650% since 2003. The U.S. accounted for the largest share, with $5.45 trillion in net assets of ETFs and 2,204 ETFs. Europe's share of global asset ETFs is 17% - $1.19 trillion, with the number of ETFs at 1,820. Assets managed by exchange-traded funds in the Asia-Pacific region totaled $690 billion (Morningstar.com; Statista.com).